Establishing an appropriate is a dynamic process, and it plays a key role in determining your portfolio's overall risk and return. As such, your portfolio's asset mix should reflect your goals at any point in time. Here we outline some different strategies of establishing and examine. Strategic Asset Allocation This method establishes and adheres to a 'base policy mix' - a proportional combination of assets based on expected for each. For example, if stocks have historically returned 10% per year and bonds have returned 5% per year, a mix of 50% stocks and 50% bonds would be expected to return 7.5% per year. Constant-Weighting Asset Allocation Strategic asset allocation generally implies a strategy, even as the shift in values of assets causes a drift from the initially established policy mix.

Your portfolio's asset mix is a key factor in whether it's profitable. And it plays a key role in determining your portfolio's overall risk and return. Find information on the current allocation and market value of asset classes in the Fund. Asset allocation mix. Asset Classes. Asset Allocation & Performance.

For this reason, you may choose to adopt a constant-weighting approach to asset allocation. With this approach, you continually your portfolio. For example, if one asset is declining in value, you would purchase more of that asset; and if that asset value is increasing, you would sell it. There are no hard-and-fast rules for timing portfolio rebalancing under strategic or constant-weighting asset allocation. However, a common is that the portfolio should be rebalanced to its original mix when any given asset class moves more than 5% from its original value.

Tactical Asset Allocation Over the long run, a strategy may seem relatively rigid. Therefore, you may find it necessary to occasionally engage in short-term, tactical deviations from the mix to capitalize on unusual or exceptional investment opportunities.

This flexibility adds a component to the portfolio, allowing you to participate in more favorable for one asset class than for others. Can be described as a moderately active strategy, since the overall strategic asset mix is returned to when desired short-term profits are achieved. This strategy demands some discipline, as you must first be able to recognize when short-term opportunities have run their course, and then rebalance the portfolio to the long-term asset position. Dynamic Asset Allocation Another active asset allocation strategy is, with which you constantly as markets rise and fall, and as the economy strengthens and weakens. With this strategy you sell assets that are declining and purchase assets that are increasing, making dynamic asset allocation the polar opposite of a constant-weighting strategy.

For example, if the is showing weakness, you sell stocks in anticipation of further decreases; and if the market is strong, you purchase stocks in anticipation of continued market gains. Insured Asset Allocation With an insured asset allocation strategy, you establish a base portfolio value under which the portfolio should not be allowed to drop. As long as the portfolio achieves a return above its base, you exercise to try to increase the portfolio value as much as possible.

If, however, the portfolio should ever drop to the base value, you invest in so that the base value becomes fixed. At such time, you would consult with your advisor on re-allocating assets, perhaps even changing your entirely. Insured asset allocation may be suitable for investors who desire a certain level of active but appreciate the security of establishing a guaranteed floor below which the portfolio is not allowed to decline. For example, an investor who wishes to establish a minimum during retirement might find an insured asset allocation strategy ideally suited to his or her management goals. Integrated Asset Allocation With integrated asset allocation, you consider both your economic expectations and your risk in establishing an asset mix. While take into account expectations for future market returns, not all of the strategies account for investment.

Integrated asset allocation, on the other hand, includes aspects of all strategies, accounting not only for expectations but also actual changes in and your risk tolerance. Integrated asset allocation is a broader asset allocation strategy, albeit allowing only either dynamic or constant-weighting allocation. Obviously, an investor would not wish to implement two strategies that compete with one another. Conclusion Asset allocation can be an active process to varying degrees or strictly passive in nature. Whether an investor chooses a precise asset allocation strategy or depends on that investor's goals, age, market expectations and risk tolerance. Keep in mind, however, that this article gives only general guidelines on how investors may use asset allocation as a part of their core strategies.

Be aware that allocation approaches that involve anticipating and reacting to market movements require a great deal of expertise and talent in using particular tools for timing these movements. Some would say that accurately timing the market is next to impossible, so make sure your strategy isn't too vulnerable to unforeseeable errors.

Asset Allocation: Management Style and Performance Measurement ASSET ALLOCATION: MANAGEMENT STYLE AND PERFORMANCE MEASUREMENT An Asset class factor model can help make order out of chaos William F. Sharpe Reprinted from the Journal of Portfolio Management, Winter 1992, pp. This copyrighted material has been reprinted with permission from The Journal of Portfolio Management. Copyright © Institutional Investor, Inc., 488 Madison Avenue, New York, N.Y. 10022, a Capital Cities/ABC, Inc. Phone (212) 224-3599.

It is widely agreed that asset allocation accounts for a large part of the variability in the return on a typical investor's portfolio. This is especially true if the overall portfolio is invested in multiple funds, each including a number of securities. Asset allocation is generally defined as the allocation of an investor's portfolio among a number of 'major' asset classes. Clearly such a generalization cannot be made operational without defining such classes. Once a set of asset classes has been defined, it is important to determine the exposures of each component of an investor's overall portfolio to movements in their returns. Such information can be aggregated to determine the investor's overall effective asset mix.

If it does not conform to the desired mix, appropriate alterations can then be made. Once a procedure for measuring exposures to variations in returns of major asset classes is in place, it is possible to determine how effectively individual fund managers have performed their functions and the extent (if any) to which value has been added through active management. Finally, the effectiveness of the investor's overall asset allocation can be compared with that of one or more benchmark asset mixes. An effective way to accomplish all these tasks is to use an asset class factor model. After describing the characteristics of such a model, we illustrate applications of a model with twelve asset classes to analyze the performance of a set of open-end mutual funds between 1985 and 1989. ASSET CLASS FACTOR MODELS Factor models are common in investment analysis.

Equation (1) is a generic representation: R i represents the return on asset i, F i1represents the value of factor 1, F i2 the value of factor 2, F in the value of the n'th (last) factor and e i the 'non-factor' component of the return on i. All these values are (potentially) unknown before-the-fact, as indicated by the tildes. The remaining values (b i1 through b in) represent the sensitivities of R i to factors F i1 through F in. A key assumption makes a model of this sort more than simply an exercise in data description: The non-factor return for one asset (e i) is assumed to be uncorrelated with that of every other (e.g. In effect, the factors are the only sources of correlation among returns. An asset class factor model can be considered a special case of the generic type. In such a model each factor represents the return on an asset class and the sensitivities (b ij values) are required to sum to 1 (100%).

In effect, the return on an asset i is represented as the return on a portfolio (shown by the sum of the terms in the bracketed expression) invested in the n asset classes plus a residual component (e i). For expository convenience, the sum of the terms in the brackets can be termed the return attributable to style and the residual component (e i) the return due to selection.

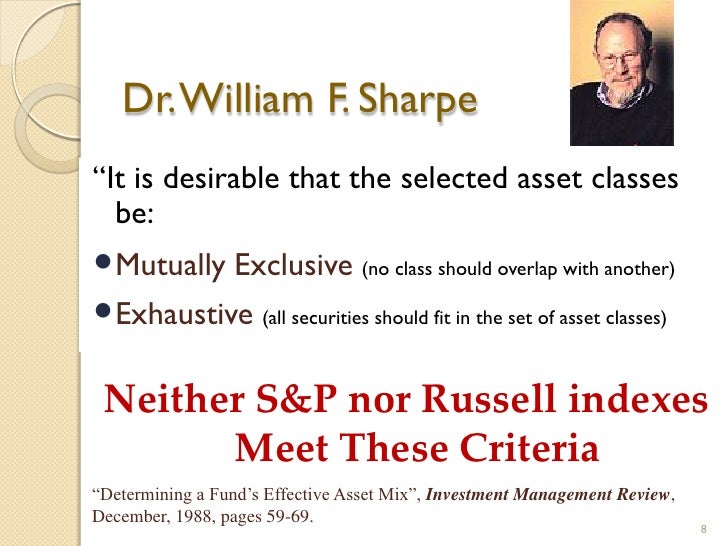

Indeed, a key contribution of this approach is the separation of return into these two main components. EVALUATING ASSET CLASS FACTOR MODELS The usefulness of an asset class factor model depends on the asset classes chosen for its implementation. While not strictly necessary, it is desirable that such asset classes be 1) mutually exclusive, 2) exhaustive and 3) have returns that 'differ'. Pragmatically, each should represent a market-capitalization weighted portfolio of securities; no security should be included in more than one asset class; as many securities as possible should be included in the chosen asset classe; and the asset class returns should either have low correlations with one another or, in cases in which correlations are high, different standard deviations.

While the appropriate measure of the efficacy of any specific implementation depends on the uses to which the model is to be put, factor models are typically evaluated on the basis of their ability to explain the returns of the assets in question (i.e. A useful metric is the proportion of variance 'explained' by the selected asset classes.

Http archive har file viewer. Web Performance Power Tool: HTTP Archive (HAR). The HAR file contains all the meta-data that you need to. But you can also feed the data into HAR Viewer. An HTTP Archive (HAR) viewer. HTTP Archive Viewer 2.0.17 - Software is hard Har Viewer.

Using the traditional definition, for asset i: The right-hand side of equation (2) equals 1 minus the proportion of variance 'unexplained'. The resulting R-squared value thus indicates the proportion of the variance of R i 'explained' by the n asset classes. It is important to recognize that this measure indicates only the extent to which a specific model fits the data at hand. A better test of the usefulness of any implementation is its ability to explain performance out-of-sample. For this reason it is important to consider not only the ability of a model to explain a given set of data but also its parsimony. Other things equal (e.g.

R-squared values), the fewer the asset classes, the more likely is the model to represent continuing fundamental relationships with predictive content. To evaluate the exposures of funds to changes in the returns of key asset classes, the appropriate measure is the collective ability of a set of such classes to explain the time-series variability in the returns on a typical fund (e.g. Mutual fund or separately-managed institutional account). Note that this criterion differs from that often applied in evaluating factor models designed to describe specific portions of the overall capital market. For example, when constructing an equity factor model, one might consider the ability of the selected factors to explain the time-series variation in the returns of a typical stock. Most stock market models include factors representing returns on industry groups and/or economic sectors - factors that account for much of the typical security's return. If most managers diversify across industries and economic sectors,however, inclusion of factors related to differences in industry and sector returns will add little if any explanatory power to a model designed to explain fund returns.

Determining A Funds Effective Asset Mix

A TWELVE ASSET CLASS MODEL The model we use has twelve asset classes. The return of each is represented by a market capitalization weighted index of the returns on a large number of securities. For reasons that will become clear, it is important to note that each index represents a strategy that could be followed at low cost using an index fund. The composition of each index is specified in sufficient detail by its provider to enable an investor to track the returns with little error through a passive (index-like) investment strategy. Table 1 describes the twelve asset classes and the indices used for the associated return series.

Most are widely used indexes that require no further description. The four less well-known are those employed to represent U.S. Equity classes. 92.22 The column in Table 2 titled 'Constrained Regression' reports the results of a multiple regression analysis similar to the first, with one added constraint: The coefficients were required to sum to 100%. The reduction in R-squared was slight (from 95.20% to 95.16%), but the inconsistency between the coeffficients and the fund's investment policy remains. The last column in Table 2 reports the results of an analysis where each coefficient is constrained to lie between 0 and 100% and the sum is again required to be 100%. As in the previous cases, the objective of the analysis was to select a set of coefficients that minimizes the 'unexplained' variation in returns (i.e., the variance of e i), subject to the stated constraints.

An equivalently goal was to maximize the associated value of R-squared, subject to the stated constraints. For this analysis, the presence of inequality constraints ( 0. Average.06% per month Std Dev 1.69% per month T(Avg) -0.25 The table below the graph in Figure 14 summarizes the results in a different manner. On average, the fund underperformed its style benchmarks by -0.06% (6 basis points) per month, with a standard deviation of 1.69% (169 basis points) per month. The t-statistic associated with the mean difference was, however, small in absolute value, suggesting that the average difference was not statistically significantly different from zero. Figure 15 emphasizes the advantages to be gained by analyzing performance the way we have described.

It compares the return on Trustees' Commingled U.S. Fund with that of Standard & Poor's 500 stock index (commonly used to evaluate mutual fund performance). The fund's performance, so measured, was over three times as bad as that shown previously: the cumulative difference was -10% and the average difference -20 basis points per month. But such a comparison includes results due to both style and selection. During the period in question the fund's style underperformed that of the S&P500 (primarily because of its exposure to small stocks). Indeed, this accounts for approximately two-thirds of the fund's underperformance relative to the S&P500.

An investor choosing Trustees' Commingled U.S. Fund could and should have known that its style favored value stocks and small stocks. The choice to expose some of the portfolio to these asset classes should be attributed to the investor.

Results (good or bad) associated with such the choice of a style should be attributed to the investor, not to the manager of a fund following that style. Average.20% per month Std Dev 2.13% per month T(Avg) -0.65 Figures 16 and 17 show the results of similar analyses for Fidelity Magellan Fund. As Figure 16 shows, the fund provided a positive but statistically insignificant outperformance when compared with the S&P500 over the period. But Figure 17 shows that such a comparison masked Magellan's truly outstanding selection performance. During this period, the fund outperformed its style benchmarks by a cumulative amount of over 25%.

Outperformance averaged 57 basis points per month with a standard deviation of 105 basis points. The t-statistic of 3.76 shows that such differences were highly significant statistically. Two aspects account for the large t-value: the relatively large average return difference and the relatively small variation in the difference from month to month. Average 0.57% per month Std Dev 1.05% per month T(Avg) 3.76 MUTUAL FUND PERFORMANCE Fidelity Magellan's performance from 1985 through 1989 is far from typical.

While only out-of-sample results can provide a definitive test of the collective performance of mutual funds, the average e i values obtained as a by-products from fund style analyses can provide at least some evidence on the matter. Figure 18 shows the distribution of the average tracking errors obtained from the style analyses of 636 stock, bond and balanced funds.

Each value is the average e i value obtained from a style analysis using returns for one fund covering the period from January 1985 through December 1989. Note that the distribution is roughly normal, with a mean of -0.074 (-7.4 basis points per month). This is roughly consistent with the hypothesis that the average mutual fund cannot 'beat the market' before costs, because such funds constitute a large (and presumably representative) part of the market.

Annualized, the mean underperformance is approximately 0.89% per year - an amount that, if anything, may be slightly less than the non-transaction costs incurred by a typical mutual fund. Average =.074 MEASURING AN INVESTOR'S PERFORMANCE In the paradigm utilized in this article, an investor makes decisions that result in an effective asset mix and a set of selection returns. In a sense, the investor selects a set of (passive or active) managers and a specific allocation of funds among such managers. Given the managers' styles, this determines the investor's effective asset mix.

The procedures described earlier can be applied directly to measure the efficacy with which the investor performs his or her functions. The performance of each month's effective asset mix can be compared with that of a predetermined benchmark asset mix to assess the value added or lost due to asset allocation decisions (advertent or inadvertent). The remainder of the investor's return is attributable to the joint effects of 1) the fund managers' selection returns, and 2) the investor's allocation of money among the managers. The investor selection return (S p) is simply: where the S i values are determined out-of-sample, using procedures such as those described earlier. CONCLUSION An asset class factor model can help make order out of the chaos that often attends the investment process.

It can provide a consistent view of investment decisions investors make to economize on information flows and exploit comparative advantages. The style analysis procedure described in this article allows such a model to be implemented economically. At the very least it can serve as a valuable supplement to other methods designed to help investors achieve their goals in cost-effective ways. Employed in Figure 14 (and the subsequent ones using similar portrayals). This makes it possible to compare vertical distances directly at any point in the figure. Because selection return represents the difference between the returns of two portfolios, compounding would not provide the difference in the cumulative values of the fund and the benchmark.

This being said, it should be pointed out that since the logarithm of a monthly value relative will generally differ little from the corresponding monthly return, a graph in which compounded selection returns are shown on a logarithmic scale appears similar to one in which returns are summed and shown on an arithmetic scale, as in this article. Is computed by dividing the average return difference by the standard error of the mean (here, the standard deviation of the return difference divided by the square root of 60). Is closely related to the reward-to-variability Ratio (sometimes termed the Sharpe Ratio) for the 'active' component of a fund's return, which is simply the mean value divided by the standard deviation. REFERENCES Mean-Variance Analyses in Portfolio Choice and Capital Markets. Oxford: Basil Blackwell, Inc. 'An Algorithm for Portfolio Improvement,' in Kenneth D. Lawrence, John B.

Advances in Mathematical Programming and Financial Planning, Vol. Greenwich: JAI Press, Inc., 1987. Determining a Fund's Effective Asset Mix,' Investment Management Review, December 1988, pp.